Africa Diesel Generator Market Competitive Situation and Trends By 2028

Africa Diesel Generator Industry Overview

The Africa diesel generator market size is expected to reach USD 8.36 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 5.7% from 2021 to 2028. The rise in demand for these products is being witnessed with the easing of lockdown restrictions in countries in Africa, which will increase the demand for diesel generators from this power range over the forecast period.

Africa Diesel Generator Market Segmentation

Grand View Research has segmented the Africa diesel generator market based on power rating, end use, and country:

Based on the Power Rating Insights, the market is segmented into Up to 100 kVA, 100-350 kVA, 350-750 kVA, 750-1000 kVA, 1000-2000 kVA, 2000-3000 kVA, Above 3000 kVA.

- The 1000-2000 kVA power rating segment led the Africa generator market and accounted for the largest revenue share of more than 42.81% in 2020. The 1000-2000 kVA diesel generator sets are primarily utilized by data centers, mining, industrial, and construction sectors. Major vendors such as Cummins, Kohler, Mitsubishi Heavy Industries, Ltd., and Caterpillar provide diesel generators in this power rating range which are capable of providing continuous power supply for a longer duration. Due to periodic outages in African countries such as Ethiopia, Ghana, Uganda, and Mali, end-users adopt for diesel generators to maintain seamlessness in operations.

- Up to 100 kVA diesel generator sets are mainly utilized in telecom towers and residential and small-scale commercial applications such as shops and clinics. The lack of power distribution infrastructure in most African countries has resulted in the demand for up to 100 kVA diesel generators from end-users. The 350-750 kVA diesel generator sets are predominantly utilized in high-end hospitals, shopping malls, small-scale industries, and business centers.

- The market for 350-750 kVA diesel generators is growing due to the requirement for regular power supply due to the critical nature of their operation. Since African countries such as Ethiopia, Ghana, Uganda, and Mali had witnessed around 13.6, 9.8, 6.9, and 6.8 power outages per month respectively in 2018.

Based on the End-use Insights, the market is segmented into Manufacturing, Construction, Telecom, Mining, Data Center, Tourism, Banking, Others.

- The telecom end-use segment led the market and accounted for the largest revenue share of more than 18.66% in 2020. Increasing demand for uninterrupted and reliable power supply from the end-use segments, such as manufacturing and construction, telecom, mining, data center, tourism, banking, and others, is anticipated to propel the market growth over the forecast period.

- Diesel generators in the range of up to 45 kVA are utilized in the telecom sector to provide emergency or continuous power supply to telecom towers. In the areas with access to grid power, diesel generators act as backup power supply options whereas in areas with no power supply diesel generators act as continuous power supply options. Diesel generators are conventionally used to power telecom towers owing to low capital cost and easy fuel availability in remote as well as developed areas.

- Others include residential, educational institutes such as schools, colleges, and commercial and government institutions such as hospitals, shops, shopping malls, government offices, and sports complexes. All these end-users require a backup power supply in case of power outages. Diesel generators have been conventionally used by these end-users owing to their economic cost and easy storage and availability of diesel fuel.

Africa Diesel Generator Country Outlook

- Kenya

- Algeria

- South Africa

- Ethiopia

- Ghana

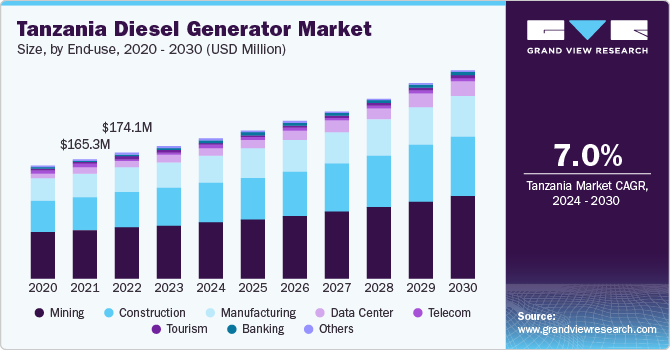

- Tanzania

- Morocco

- Mali

- Uganda

Key Companies Profile & Market Share Insights

The market is highly characterized by the expansion and joint venture strategies opted by diesel generator companies across the region. Established players such as Cummins are investing in product development to gain a competitive edge in the market.

Some of the prominent players operating in the Africa diesel generator market include,

- Caterpillar

- Cummins Inc.

- Atlas Copco AB

- AKSA power generation

- Kohler Co

- HIMOINSA

- Wartsila

- Kirloskar Oil Engines Ltd.

- MITSUBISHI HEAVY INDUSTRY LTD.

Order a free sample PDF of the Africa Diesel Generator Market Intelligence Study, published by Grand View Research.