Amino Acids Market Current And Future Industry Landscape Analysis Report by 2030

Amino Acids Industry Overview

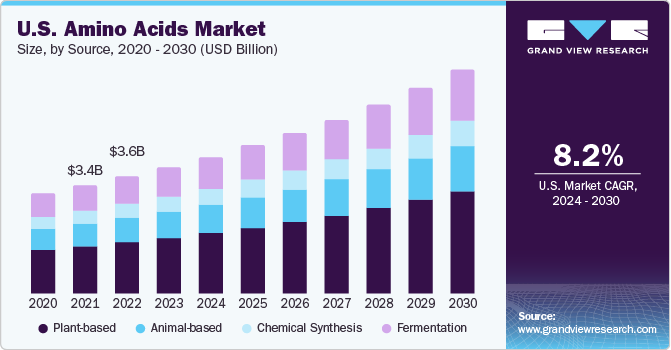

The global amino acids market size is projected to reach USD 49.7 billion by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 7.4% from 2022 to 2030. The growing consumer awareness regarding a healthy lifestyle, coupled with the increasing consumption of meat and meat products, is anticipated to drive the demand for amino acids during the forecast period.

Amino Acids Market Segmentation

Grand View Research has segmented the global amino acids market on the basis of raw material, product, application, livestock, and region:

Based on the Raw Material Insights, the market is segmented into Plant Based and Animal Based.

- The plant-based raw material segment accounted for the largest revenue share of 86.0% in 2021 and is expected to witness the fastest growth during the forecast period, owing to the rising consumer preference for naturally sourced products.

- Growing product demand from animal feed manufacturing companies, along with increasing consumption of dietary supplement formulations, is expected to augment the lysine demand during the projected period.

Based on the Product Insights, the market is segmented into L-Glutamate, Lysine, Methionine, Threonine, Tryptophan, Leucine, Iso-Leucine, Valine, Glutamine, Arginine, Glycine, Phenylalanine, Tyrosine, Citrulline, Creatine, Proline, Serine, and Others.

- L-glutamate accounted for the largest volume share of 47.5% in 2021 and is anticipated to maintain its lead over the forecast period. L-glutamate, also known as l-glutamic acid, is a non-essential amino acid. It is extensively used as a nutritional supplement, flavor enhancer, feed additive, and intermediate for manufacturing organic chemicals.

- Lysine being an essential amino acid has witnessed remarkable demand growth in the recent past. As the human body cannot synthesize such acid, its demand is moderately driven by the growth of the dietary supplements market.

Based on the Application Insights, the market is segmented into Animal Feed, Food & Dietary Supplements, and Pharmaceutical.

- The animal feed segment is expected to witness the fastest growth in the market during the forecast period. Amino acids are used as additives in animal feed formulations to promote growth performance, and reproduction, and to fulfill the protein requirement in animals.

- The food and dietary supplements application accounted for the largest segment volume share of 56.1% in 2021 and is anticipated to maintain its lead during the forecast period.

Based on the Livestock Insights, the market is segmented into Swine, Poultry, Cattle, and Others.

- The poultry segment accounted for the largest revenue share of 41.8% in 2021 and is expected to witness the fastest growth during the forecast period. The poultry segment consists of chicken, duck, turkey, and broilers. The increasing number of fast-food chains and growing demand for processed food in the Asia Pacific and North America are driving the demand for poultry products in these regions.

Amino Acids Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa

Key Companies Profile & Market Share Insights

The market has been characterized by the presence of established players with large production capacities. With the augmented product demand, they are focusing on acquisitions, expansion, and investment strategies to enhance their product portfolio and meet the growing demand from end-use markets.

Some prominent players in the global amino acids market include

- Ajinomoto Co., Inc.

- AMINO GmbH

- Taiwan Amino Acids Co. Ltd.

- KYOWA HAKKO BIO CO., LTD.

- Evonik Industries AG

Order a free sample PDF of the Amino Acids Market Intelligence Study, published by Grand View Research.