Biotech Ingredients Market Business Environment Analysis and Dynamics 2027

Biotech Ingredients Industry Overview

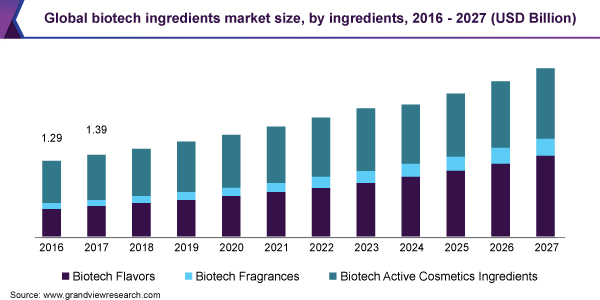

The global biotech ingredients market size is expected to reach USD 3.01 billion by 2027, according to a new report by Grand View Research, Inc., expanding at a CAGR of 9.3% from 2020 to 2027. Growing consumer inclination towards natural and organic products is expected to drive the demand for biotech ingredients over the forecast period.

Biotech Ingredients Market Segmentation

Grand View Research has segmented the global biotech ingredients market on the basis of flavors, fragrances, active cosmetic ingredients, and region:

Based on the Flavors Insights, the market is segmented into Source, Product, and Carbonyls

- In terms of revenue, biotech flavor ingredients accounted for a share of 38.44% in 2019. Flavors can be classified as natural flavors and artificial flavors. Natural flavors are usually sourced from edible essential oils, oleoresins, essence or extract from fruits/fruit juices, spices, vegetables/vegetable juices, herbs, roots, and buds. Artificial or synthetic flavors come from inedible sources, such as petroleum or paper pulp, which are processed to produce aroma chemicals for different flavors.

- Artificial flavors are cheaper than their natural counterparts as they do not require high investments in cultivating and harvesting fields. Artificial flavors could also be tailored to enhance a particular flavor according to one’s needs. However, health concerns related to consuming synthetic flavors and stringent rules and regulations on the use of these flavors in food and beverages are likely to restrain the product demand to a certain extent.

- Vanillin is considered the most widely used flavoring agent, especially in dairy and food products. It imparts a sweet flavor to the finished food products, including bakery products, alcoholic beverages, dietary supplements, dairy products, and confectioneries. Demand for vanillin from the food and beverage segment is anticipated to increase over the years ahead due to its ability to enhance flavor in food products, coupled with low-calorie content.

Based on the Fragrances Insights, the market is segmented into Application

- In terms of revenue, Europe dominated the biotech fragrance market with a share of 57.66% in 2019. Europe’s high priority for development of bio-based sector along with various strategies and policies to achieve sustainable economic growth is likely to foster the demand for biotech ingredients in the region.

- Biotech fragrances are aromatic mixtures consisting of many individual chemicals and are used in a number of applications, such as perfumes, air fresheners, candles, toiletries, personal care products, dyes, and bleaches. Increased demand for fragrances in cosmetics, personal care products, and toiletries, such as soaps, detergents, and hand washes, is projected to boost overall product demand.

- Fragrances are normally derived from plants and are largely dependent on the uninterrupted supply of essential oilsfor the production of scents for food and drinks, cleaning products, and perfumes. However, a natural disaster or any political disruption can easily affect the supply. Thus, in order to overcome such situations, the fragrance companies are now aiming to produce fragrances using lab-engineered yeast and bacteria.

Based on the Active Cosmetic Ingredients Insights, the market is segmented into Application

- The skin care segment held the largest share of 51.49% in 2019. Rising global population, along with increasing interest in physical appearance, has led to the growth of the cosmetics market worldwide. Moreover, mounting concerns for aging skin and need for an evenly toned skin are likely to contribute to this growth, which, in turn, is boosting the growth of the global cosmetic ingredients market. However, consumers these days are more concerned about the ingredients being used in cosmetic products. They are shifting towards more natural products derived from natural ingredients.

- Changing consumer dynamics have led the cosmetic companies to adopt scientific research and new product developments through sustainable means. Moreover, consumers have become more conscious towards the environment and sustainability issues, which compels these companies to consider this factor while developing new cosmetic ingredients.

- In addition, key players in the market are investing in several research and development activities for developing sustainable and innovative products using biotechnology. Moreover, they are entering into strategic alliances with other market players in order to broaden the product portfolio. For instance, in June 2019, Symrise acquired Cutech, an Italian biotech company, which offers screening for cosmetic ingredients and formulations.

Biotech Ingredients Regional Outlook

- North America

- Europe

- Asia Pacific

- Middle East & Africa (MEA)

- Central & South America

Key Companies Profile & Market Share Insights

Key players in the market are developing flavors using microbial processes, such as biosynthesis or biotransformation, using bacteria, yeast, or fungi. Companies are focusing on R&D based on biotechnology to invent novel microbial fermentation processes for manufacturing natural vanillin.

Some of the prominent players in the global biotech ingredients market include:

- Givaudan SA

- International Flavors & Fragrance (IFF), Inc.

- Firmenich SA

- Amyris, Inc.

- Sollice

- Novocap Group

- Evolva S.A.

Order a free sample PDF of the Biotech Ingredients Market Intelligence Study, published by Grand View Research.