Endoscopy Operative Devices Market Growth, Striking Opportunities, And Forecasts To 2028

Endoscopy Operative Devices Industry Overview

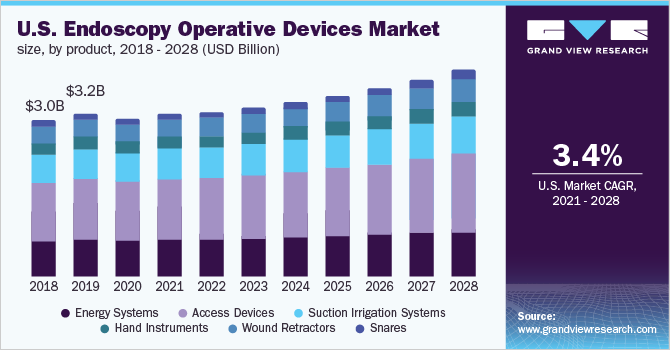

The global endoscopy operative devices market size was valued at USD 8.0 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2021 to 2028.

The increasing prevalence of chronic disorders, such as obesity, diabetes, and cancer, coupled with the growing geriatric population, is expected to boost the demand for endoscopies. The rising awareness regarding the benefits associated with minimally invasive procedures, such as lesser post-operative complications and shortened hospitalization and recovery time, is further surging the demand for these procedures. The rising incidence of urological, respiratory, gastrointestinal, and gynecological disorders requiring endoscopy for diagnosing and treating the disorders is expected to propel the market growth.

Gather more insights about the market drivers, restrains and growth of the Global Endoscopy Operative Devices Market

The growing demand for endoscopy operative devices for diagnostic and therapeutic processes, coupled with the rising prevalence of age-related ailments across the globe, is expected to provide an impetus to the market growth. These devices play a vital role in diagnosing and treating disorders since they enable minimal intervention and results in a shorter recovery period. The global geriatric population suffering from gall stones, liver abscess, pelvic abscess, intestinal perforation, and endometriosis requires endoscopic procedures to treat the underlying disorder. According to the estimates published by the United Nations in 2020, the global geriatric population aged 65 or above in 2019 was nearly 727 million, accounting for 9.3% of the global population, and is expected to reach an estimated population of over 1.5 billion by 2050, representing 16.0% of the global population. This growth in the geriatric population susceptible to contracting chronic disorders requiring endoscopic procedures is expected to drive the market over the forthcoming years.

The growing number of healthcare centers such as hospitals, cancer centers, oncology specialty clinics, endoscopy centers, and diagnostic centers is leading to an increase in demand for endoscopes and operative devices, which is potentially driving the market. Developed and emerging economies are constantly upgrading their healthcare infrastructure to accommodate the growing demand for diagnostic and therapeutic procedures across the patient population. In 2018, approximately 6,396 hospitals were there in the U.S., which is anticipated to expand at a CAGR of 4.6% by 2025. Moreover, in Europe, the U.K. had the highest number of hospitals, accounting for 3,186 in 2018, and it is expected to reach 10,027 hospitals by the end of 2025, expanding at a CAGR of 18.0%. Furthermore, countries such as Brazil and South Africa are expected to register a significant increase in the number of hospitals with a CAGR of 10.1% and 11.8%, respectively. Similarly, oncology specialty centers and diagnostic centers are growing at a lucrative rate. The growth in the number of healthcare centers is expected to support the demand for endoscopy operative devices.

Browse through Grand View Research’s Medical Devices Industry Research Reports.

- Endoscopes Market – The global endoscopes market size was valued at USD 12.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.4% from 2022 to 2030.

- Endoscopy Devices Market – The endoscopy devices market size was valued at USD 42.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2022 to 2030.

Market Share Insights

- January 2020: PENTAX Medical launched IMAGINA Endoscopy System for Gastrointestinal (GI) procedures at ambulatory surgery centers in the U.S. The company also announced that it received clearance from the U.S. Food and Drug Administration for this device.

- June 2019: Medtronic announced its 4-year partnership with Karl Storz. The two companies have been working together to integrate Karl Storz’s 3D vision systems into Medtronic’s robotic surgical platform.

- August 2018: Pentax Medical announced the acquisition of controlling interest of PlasmaBiotics SAS, which designs, manufactures, and markets devices used for drying and storing endoscopes.

- October 2017: Olympus Corporation expanded its GI endoscopic device line with the launch of 3-in-1 SB Knives that enable mucosal incision as well as controlled precision cutting.

Key Companies profiled:

Some prominent players in the global endoscopy operative devices market include

- Cook Medical Inc.

- Medtronic

- Boston Scientific Corporation

- Stryker

- Ethicon Endo-Surgery, Inc.

- Karl Storz

- CONMED Corporation

- Richard Wolf GmbH

- Fujifilm Holdings Corporation

- Olympus

Order a free sample PDF of the Endoscopy Operative Devices Market Intelligence Study, published by Grand View Research.