Global Energy Trading and Risk Management (ETRM) Market-Industry Analysis and fo

Global Energy Trading and Risk Management (ETRM) Market size was valued US$ XX Bn. in 2019 and the total revenue is expected to grow at 3.21% through 2019 to 2027, reaching nearly US$ XX Bn.

The report covers an in-depth analysis of COVID 19 pandemic impact on Global Energy Trading and Risk Management (ETRM) Market by region and on the key players’ revenue affected till July 2020 and expected short term and long-term impact on the market.

The report covers an in-depth analysis of COVID 19 pandemic impact on Global Energy Trading and Risk Management (ETRM) Market by region and on the key players’ revenue affected till July 2020 and expected short term and long-term impact on the market.

Energy trading & risk management (ETRM) is a market execution tool in an integrated system and commercial decision making. It enables data exchanges among operations, trade floor, credit, contract, and accounting functions.

The energy sector is using the ETRM systems to help them tackle many needs such as reduce risk coverage, regulatory compliance, and to speed up the trading activities. The prominent ETRM players will essential to expand beyond oil & gas into renewable energy to support their existing client base, particularly the traditional oil. The demand for energy trading & risk management products is growing in correlation with the collateral and trading management platforms for large sell-side firms. The absence of regulatory compliances is a warning for new entrants. Moreover, major opportunities in the market are growing financial risks and the growth of foremost business organizations. On the other hand, a lack of technical expertise is projected to impede the ETRM market growth globally.

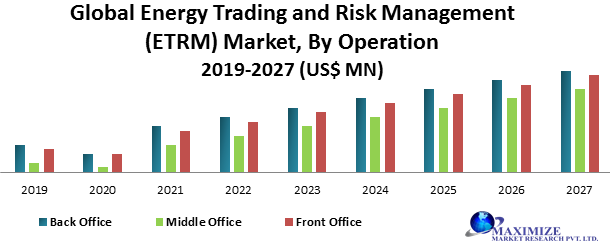

The report covers the segments in the Energy Trading and Risk Management (ETRM) market such as operation, and application. By operation, the back office segment was valued at US$ XX Mn. in 2019 and is expected to reach US$ XX Mn. by 2027 at a CAGR of XX.33% over the forecast period. The back office transmits out accounting operations and derivative accounting tasks and conducts the inventory.

By Region (2019 size in US$ MN):

Global Energy Trading and Risk Management (ETRM) Market1

Geographically, APAC is expected to account for the largest share XX% in Energy Trading and Risk Management (ETRM) market thanks to growing the new market for energy trading business. So, the region is estimated to display a demand for ETRM solutions during 2019-2027. The demand for ETRM software is high in developing countries.

Europe ETRM Market has valued USD XX.12 Mn in 2019 and is expected to reach USD XX.85 Mn by 2027, at an XX.76% CAGR during a forecast period. The European power industry has developed over time mainly as regional markets within economies like the UK, France, and Nordic. In the Nordic market, the Brady ETRM software products dominate while several other Nordic-centric solutions exist as well as some of the Powels solutions.

The competitive landscape section in the Energy Trading and Risk Management (ETRM) Market offers a deep dive into the profiles of the leading companies operating in the global market landscape. It offers captivating insights on the key developments, differential strategies, and other crucial aspects about the key players having a stronghold in the Energy Trading and Risk Management (ETRM) Market.

The objective of the report is to present a comprehensive analysis of the Global Energy Trading and Risk Management (ETRM) Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers.

The report also helps in understanding Global Energy Trading and Risk Management (ETRM) Market dynamics, structure by analyzing the market segments and projects the Global Energy Trading and Risk Management (ETRM) Market size. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Energy Trading and Risk Management (ETRM) Market make the report investor’s guide.

For More Information Visit @:

Scope of the Global Energy Trading and Risk Management (ETRM) Market

Global Energy Trading and Risk Management (ETRM) Market, By Application

• Energy Producers

• Energy Suppliers

• Large Energy Consumers

• Energy Traders

• Others

Global Energy Trading and Risk Management (ETRM) Market, By Operation

• Front Office

• Back Office

• Middle Office

Global Energy Trading and Risk Management (ETRM) Market, By Region

• North America

• Europe

• Asia Pacific

• Middle East & Africa

• South America

Key players operating in the Global Energy Trading and Risk Management (ETRM) Market

• Allegro Development Corporation

• Amphora Inc.

• Triple Point Technology Inc.

• Openlink LLC.

• Eka Software Solutions

• SAP

• Accenture

• Sapient

• Ventyx

• Trayport

• Calvus

• FIS

• Others

This Report Is Submitted By : Maximize Market Research Company

Customization of the report:

Maximize Market Research provides free personalized of reports as per your demand. This report can be personalized to meet your requirements. Get in touch with us and our sales team will guarantee provide you to get a report that suits your necessities.

About Maximize Market Research:

Maximize Market Research provides B2B and B2C research on 20,000 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.