Point Of Sale Software Market Size, And Company Financial Performances 2028

Point Of Sale Software Industry Overview

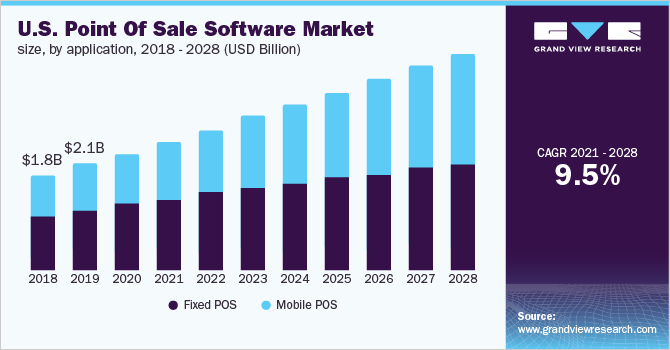

The global point of sale software market size was valued at USD 9.26 billion in 2020 and is expected to register a compound annual growth rate (CAGR) of 9.5% from 2021 to 2028.

The COVID-19 pandemic negatively affected several business sectors including retail, restaurant, travel, and entertainment, subsequently affecting the profitability of point of sale (POS) software vendors. However, increased demand for contactless payment options came as respite, creating a favorable scenario for market players. Although the pandemic had an adverse impact on several sectors, a few industries including retail and restaurants sustained due to online shopping and food delivery system. The shift to online sales led to a rise in the number of online food deliveries and groceries that favored the demand for contactless payment getaways.

POS solutions have made in-roads to several sectors owing to their ability to offer custom and advanced analytical functions. These terminals or systems backed by powerful software capabilities help business operators to ease out day-to-day business activities while helping them focus on their core business activities. Increased demand for tailored-made POS or check-out systems across diverse business applications will result in the development of sophisticated software solutions that form the core element of these systems. The development of software that supports an array of sectors while offering analytical capabilities to monitor the data captured through daily business operations is expected to upkeep the market growth over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Point Of Sale Software Market

A trend to develop software for standalone terminals or building an all-in-one system for retail/restaurant chains is also expected to favor industry growth over the next seven years. A POS software offers the flexibility of installation on different devices, including desktops, tablets, or laptops. It is compatible with any operating system, making it a go-to choice for any vendor. The ability to deploy web-based solutions, specifically among SMBs, is also a key emerging trend in the industry. The cloud-based mPOS software demand has gained traction owing to cost-effective and hassle-free installation. Small businesses are also more inclined to deploy web-based solutions owing to their affordability and direct access from the internet or web browser, which is expected to impel the overall market growth over the forecast period.

POS software providers consider various factors during the software development phase, such as support to a myriad of operating systems, payment modes, and the ability to create and manage customer databases in a structured format. For instance, merchants demand a flexible and cost-effective POS solution compatible with various hardware devices, such as laptops, mobile, PC, and tablets. These hardware devices operate on different operating systems, such as Windows, Linux, Mac OS, Android, and iOS, and need compatible software. Thereby, vendors ensure the availability of software for different devices and operating systems to cater to large and small businesses alike.

The COVID-19 pandemic has changed the business landscape wherein end-users are compelled to use modern point of sale technology. Upgraded POS solutions to facilitate online orders & payments and unified analytics would help understand & meet new customer expectations, adapt to market change, prepare for future lockdowns or similar situations, and improve the ability to sell both online and in-store. The retail, packaged food service, and other businesses opted for online sales channels (e-commerce) to cater to consumer needs during the pandemic by offering contactless product delivery at the doorstep. POS vendors leveraged this opportunity to upgrade solutions for retailers and restaurateurs to enable their management of both online and in-store sale information and payment option. The market vendors found new growth avenues by capturing the changing demand scenario. However, the restricted movement and ban on non-essential services affected the end-user revenue growth, consequently impacting the demand for POS systems and compatible software.

Browse through Grand View Research’s Communications Infrastructure Industry Research Reports.

- Laptop Market – The global laptop market size was valued at USD 101.67 billion in 2017. It is estimated to expand at a CAGR of 0.4% during the forecast period. In terms of volume, the market is anticipated to register a CAGR of 1.0% during the same period.

- Point-of-Sale Terminals Market – The global point-of-sale terminals market size was valued at USD 85.16 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 8.5% from 2022 to 2030.

Point-of-Sale Software Market Segmentation

Grand View Research has segmented the global point of sale software market on the basis of application, deployment mode, organization size, end-user, and region:

- Point Of Sale Software Application Outlook (Revenue, USD Million, 2016 – 2028)

- Fixed

- Mobile

- Point Of Sale Software Deployment Mode Outlook (Revenue, USD Million, 2016 – 2028)

- Cloud

- On-premise

- Point Of Sale Software Organization Size Outlook (Revenue, USD Million, 2016 – 2028)

- Large Enterprise

- Small and Medium Enterprise (SME)

- Point Of Sale Software End-user Outlook (Revenue, USD Million, 2016 – 2028)

- Restaurants

- Hospitality

- Healthcare

- Retail

- Warehouse

- Entertainment

- Others

- Point Of Sale Software Regional Outlook (Revenue, USD Million 2016 – 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights

- June 2021: Toast acquired xtraChef, which provides customized back-office automation for inventory management and accounts payable. The acquisition is aimed at enhancing the Toast POS solution for managing restaurant financial health.

- March 2021: Lightspeed acquired Vend Limited, a cloud-based retail management software vendor based in New Zealand. The acquisition was aimed at strengthening the company’s customer base in retail sector and establishing a strong foothold as a global Omni channel retail platform that can be integrated with POS for small- and medium-sized businesses.

Key Companies profiled:

Some prominent players in the global point of sale software market include

- Clover Network, Inc.

- H&L POS

- IdealPOS

- Lightspeed

- NCR Corporation

- Oracle Micros

- Revel Systems

- SwiftPOS

- Square Inc.

- TouchBistro

- Toast Inc.

Order a free sample PDF of the Point Of Sale Software Market Intelligence Study, published by Grand View Research.