Steel Pipes & Tubes Market Analysis, Growth Opportunities and Forecast to 2027

Steel Pipes & Tubes Industry Overview

The global steel pipes & tubes market size is anticipated to reach USD 231.1 billion by 2027 registering a CAGR of 6.2%, according to a new report by Grand View Research, Inc. Long-term demand for energy on the global level is anticipated to boost the market growth. According to the EIA, global energy consumption is projected to reach 736 quadrillion BTU by 2040 from 575 quadrillion BTU in 2015, witnessing an increase of 28%. The use of liquid fuels and petroleum is likely to grow from 90 million b/d in 2012 to 1000 million b/d by 2040 on a global level. The growth in demand for these liquid fuels is mainly due to the industrial and transportation sectors.

Steel Pipes & Tubes Market Segmentation

Grand View Research has segmented the global steel pipes & tubes market on the basis of technology, application, and region:

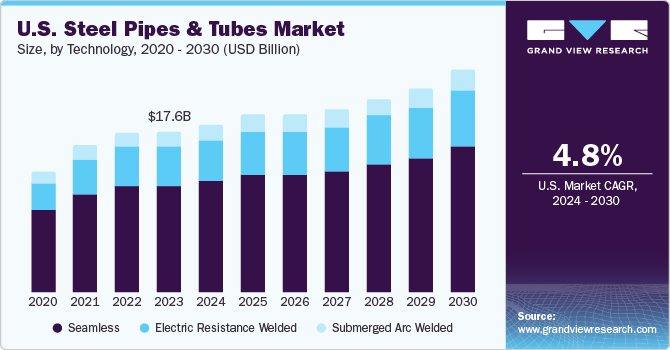

Based on the Technology Insights, the market is segmented into Seamless, ERW and SAW.

- In terms of volume, seamless accounted for a market share of over 54% in 2019. Seamless steel products are manufactured from billets that are perforated and heated to create the tubular section. There are no seam welds in such products. Seamless pipes & tubes are used in a variety of sectors including oil & gas, power generation, chemicals & petrochemicals, and engineering.

- The oil & gas sector dominates the seamless technology segment. The oil & gas industry requires tubular products that can withstand high pressure, corrosive atmosphere, pressure, and mechanical stress. Thus, these products are used for different applications within the oil & gas sector including upstream operations (Oil Country Tubular Goods (OCTG)), midstream (transmission and distribution of oil, gas, fluids, acids, steam, and slurries), and downstream (petroleum: process piping in order to refine oil & gas).

- Since the past few years, ERW pipes & tubes are gaining prominence in the market owing to their low prices and modest performance. Modern welding technologies, such as high-frequency welding, that are being increasingly integrated into the process of manufacturing ERW pipes & tubes act as a crucial factor supporting the segment growth.

Based on the Application Insights, the market is segmented into Oil & Gas, Chemicals & petrochemicals, Construction, Automotive & transportation, Mechanical engineering, Power plant and Others.

- The oil & gas segment led the market in 2019 and accounted for the highest revenue share of over 51%. The segment will retain the leading position over the forecast years due to diverse applications of the products in the oil & gas sector, ranging from OCTG, transportation to process piping for refining crude oil into petroleum products.

- In terms of volume, the chemicals & petrochemicals segment is anticipated to denote a CAGR of 5.0% from 2020 to 2027. Steel pipes & tubes are increasingly used in petrochemical plants for process refining on account of their characteristics, such as strong corrosion and oxidation resistance. Moreover, they can withstand varying degrees of pressurization.

- Rapid industrialization & urbanization, increasing population, and growth in the manufacturing sectors, especially in developing economies, are expected to augment the construction industry segment growth. This, in turn, is likely to increase product demand. China, India, and the U.S. are the leading construction markets globally.

Steel Pipes & Tubes Regional Outlook

- North America

- Europe

- Asia Pacific

- Middle East & Africa (MEA)

- Central & South America

Key Companies Profile & Market Share Insights

Due to the COVID-19 pandemic, vendors of the market are facing challenges as the demand for steel pipes and tubes continues to take a dip in FY 2020. The shutting down of production facilities is likely to further inflict the economic burden on industry participants. From a supply perspective, the overall crude steel production declined by nearly 6% (Y-o-Y) from March 2019 to March 2020, as per the data published by the World Steel Association in April 2020.

Some of the prominent players in the steel pipes & tubes market include:

- ArcelorMittal

- United States Steel

- Nippon Steel Corporation

- Tata Steel

- Jindal Steel & Power Ltd. (JSPL)

- Rama Steel Tubes Limited

- Steel Authority of India Limited (SAIL)

Order a free sample PDF of the Steel Pipes & Tubes Market Intelligence Study, published by Grand View Research.