The Different Types of Options on the IQ option platform

What are options? An option is a contract that gives you the right to buy or sell an asset at a preset price at a specified moment of time in the future.

Example of an option

Let’s take an example. Company A sells petrol. The cost price of petrol includes among other things the cost of raw material. In our case it’s oil. Oil prices are changing constantly. So the company decides to use an oil options contract in order to mitigate the risk of oil price increase.

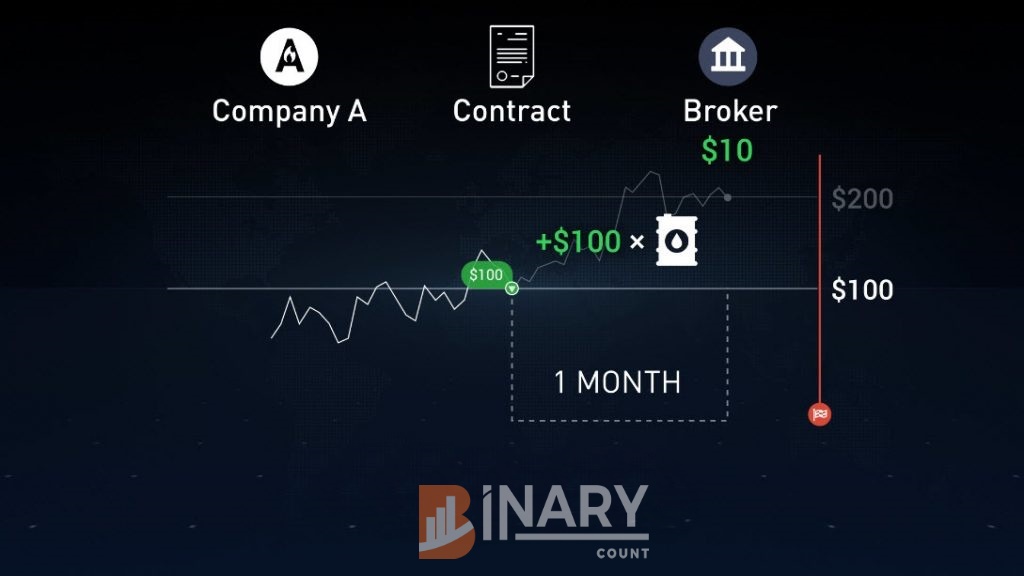

So how does the option contract work? For example, oil now costs 100 dollars per barrel. Company A goes to an exchange and concludes an options contract with a broker for purchasing oil at 100 dollars next month.

The company has to pay the cost of the option contract also called the option premium to the broker. For the sake of the example let’s say the option premium is 10 dollars. Now let’s study two scenarios.

One month later the price of oil rises to 200 dollars per barrel as Company A has the option contract for purchasing oil at one hundred dollars, it can use its option contract, exercise the option and buy oil at the agreed price of 100 dollars. Thus saving one hundred dollars per each acquired barrel.

Example use of put option when oil price is going up

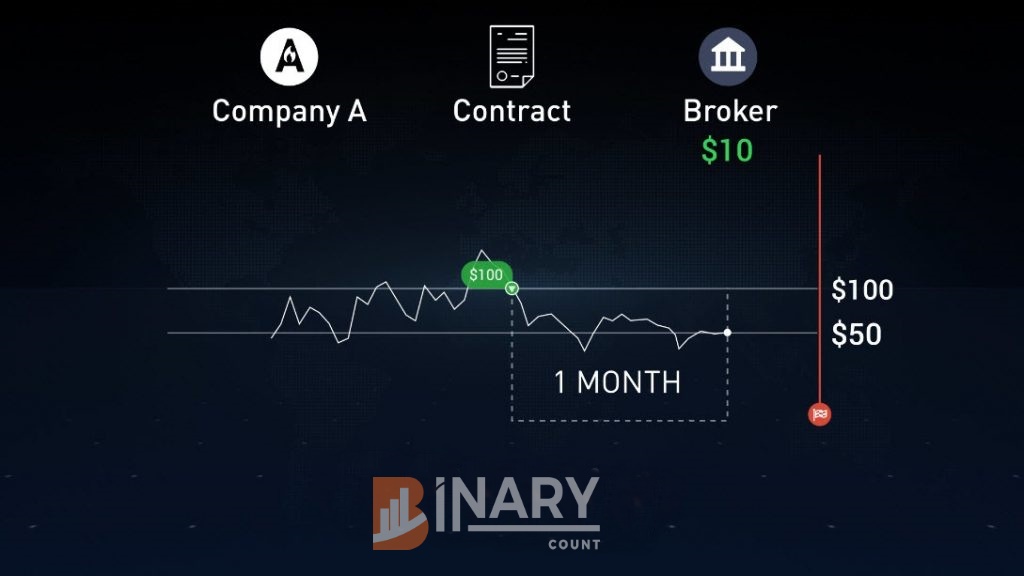

But what if the oil price drops to fifty dollars. In this case, there is no point in buying oil at the agreed price of 100 dollars. As the commodity is available at fifty dollars on the market. In this case, the company does not exercise the option and pays only the option premium to the broker.

Example use of put option when oil price is going down

Specific terms for trading options

Options trading has its specific terms:

-

The purchase time is the time when a trader buys an option.

-

The expiration time is the predetermined point in the future after which an option ceases to exist.

-

The price of an option contract is called an option premium.

-

The strike price is a target level that the opening price of an asset should go above or below for the position to close in the money.

Main types of options at IQ Option

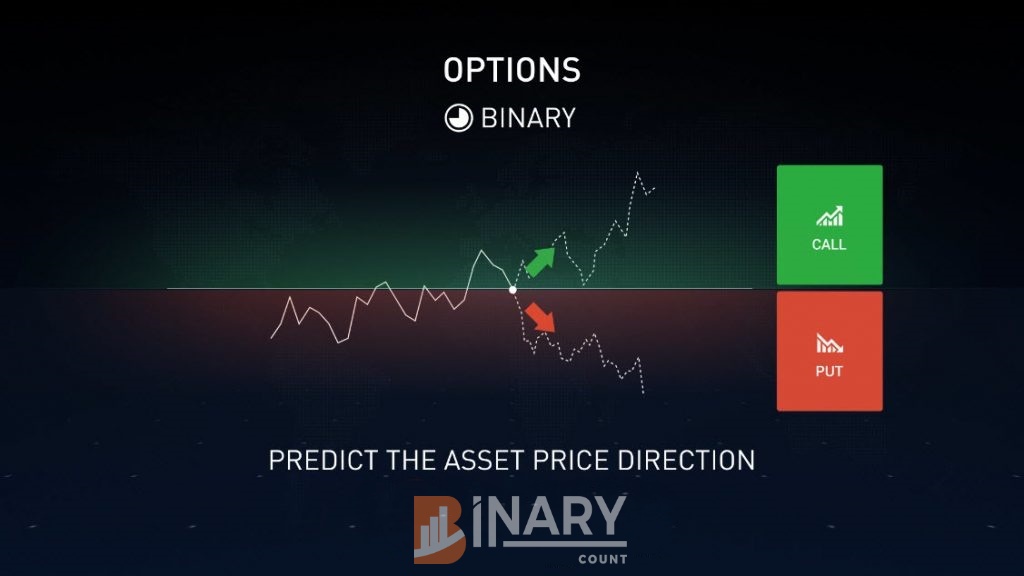

There are two main types of options. Call Options ‘calls’ and put options ‘puts’. A call option gives you the right to buy an asset, a put option gives you the right to sell an asset.

Call and put options

Options trading at IQ Option

Options is a popular trading instrument that has many variations at the best crypto platform. If you choose binary options trading you should predict the asset price direction whether the price will go up or down compared to the opening price.

Digital options allow you to choose strike prices. Thus managing your risk more efficiently.

Foreign exchange options or FX options give you the right to exchange one currency for another at a preset exchange rate at a specified moment in time in the future. FX options have strike prices like digital options. On IQ Option platform you can trade binary options, digital options and FX options.