U.S. Self-checkout Systems Market Global Key Player, Demand, Growth, and Forecasts To 2028

U.S. Self-checkout Systems Industry Overview

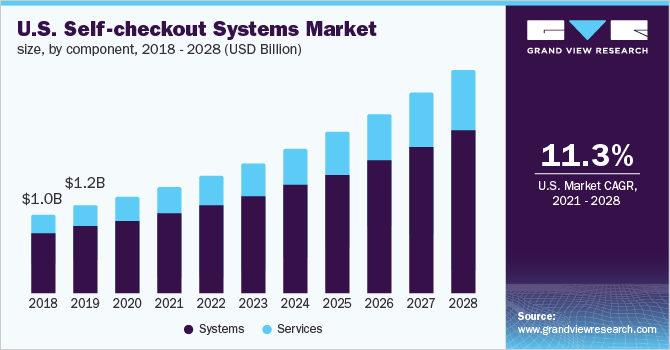

The U.S. self-checkout systems market size was valued at USD 1.26 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 11.3% from 2021 to 2028.

The changing consumer preferences to purchase products offline after experiencing and testing products personally are prompting retail store chains in the U.S. to install self-checkout systems to enhance the consumer experience, thereby driving the growth of the market over the forecast period. The strategies being pursued by the operators of retail outlets in the U.S. to roll out self-checkout systems as part of the efforts to serve a larger customer base and gain a competitive edge over their rivals are expected to contribute toward the growth of the market. The continued advances and automation in the U.S. retail industry also bode well for the growth of the market over the forecast period.

Rising employee costs and real estate costs coupled with the soaring competition from e-commerce channels are some of the major challenges the retail industry in the U.S. has been confronting. As a result, operators of the retail stores in the U.S. are putting a strong emphasis on improving productivity and reducing overhead costs. Retail stores in the U.S. are particularly looking forward to investing in self-service solutions to improve customer experience and stand out in the competition. Self-checkout systems are emerging as one of the promising self-service solutions, which can potentially help retail owners in freeing up their staff from the checkout counters and deploying them on other operations to improve overall productivity.

Gather more insights about the market drivers, restrains and growth of the U.S. Self-checkout Systems Market

The changing consumer preference towards self-service solutions is also emerging as one of the decisive factors driving the growth of the market. Tech-savvy consumers are particularly demanding for convenient, secure, and self-assisted shopping experiences at retail stores. Advances in technology and the changing technological trends are prompting retailers to aggressively adopt cashless self-checkout systems, which can typically allow consumers to shop securely and checkout without any manual intervention. For instance, having realized the growing preference for self-service among millennial customers, Key Food Montague, a grocery store based in New York, U.S., implemented Toshiba Global Commerce Solutions cashless self-checkout systems in August 2017 as part of the efforts to gain a competitive edge.

Advances in self-checkout systems are equally contributing to the growth of the market. Manufacturers of self-checkout systems are increasingly adopting the latest technologies, including Artificial Intelligence (AI), machine vision systems, and ceiling-based cameras, to help retailers in curbing the instances of shoplifting. Modern self-checkout systems are also allowing vendors to promote brands and advertisements and helping retailers in improving their brand presence. The trend of installing self-checkout systems integrated with Radio Frequency Identification Device (RFID) and Near Field Communication (NFC) technologies and mobile capabilities has also been gaining traction as retailers are putting a strong emphasis on improving purchase efficiency.

The outbreak of the COVID-19 pandemic took a severe toll on the U.S. self-checkout systems market in 2020. Retail outlets were operating at limited capacity as part of the restrictions imposed on the movement of people to arrest the spread of coronavirus. At the same time, the demand for self-checkout systems plummeted as customers opted for contactless solutions in the wake of the outbreak of the pandemic. While retail transformation projects were suspended temporarily, a looming shortage of components due to supply chain disruptions also affected the manufacturing activities at the manufacturers of self-checkout systems.

Browse through Grand View Research’s Electronic Devices Industry Research Reports.

- Specialty Lighting Market: The global specialty lighting market size was valued at USD 5.3 billion in 2019. It is projected to expand at a compound annual growth rate (CAGR) of 7.0% from 2020 to 2027.

- Inkjet Printers Market: The global inkjet printers market size was valued at USD 34.24 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2020 to 2027.

Market Share Insights

- January 2020: New York Council announced to pass a bill to ban cashless brick and mortar stores to reduce discrimination against members that do not have access to credit cards or are unbanked.

- November 2019: NCR Corporation acquired POS Solutions, a point-of-sale solution provider for the retail and hospitality industry based in the U.S. The company envisaged leveraging the acquisition to strengthen its network and provide innovative solutions to the customers.

Key Companies profiled:

Some of the prominent players in the U.S. self-checkout systems market include:

- NCR Corporation

- Toshiba Global Commerce Solutions

- Fujitsu

- Diebold Nixdorf, Incorporated

- Posiflex Technology, Inc.

- Glory Global Solutions (International) Limited

- Deltrix Kiosks

- Acrelec

- Clientron

- Gilbarco Inc.

Order a free sample PDF of the U.S. Self-checkout Systems Market Intelligence Study, published by Grand View Research.