Veterinary Dietary Supplements Market Technological Advancements, Forecast & Opportunities 2028

Veterinary Dietary Supplements Industry Overview

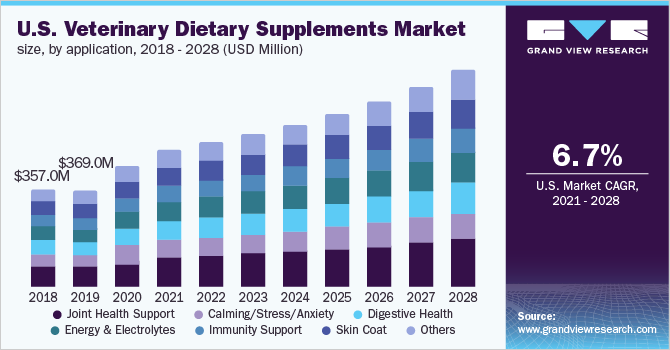

The global veterinary dietary supplements market size was valued at USD 1.6 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.2% from 2021 to 2028.

Growing need to treat, mitigate, or prevent diseases in livestock and companion animals and the rising pet population and humanization are some of the key drivers contributing to market growth. According to 2020 report by FONA International Inc., millennials and Gen-Z generations are driving the humanization and premiumization trends in the pet food market, including veterinary dietary supplements.

The COVID-19 pandemic has propelled the demand for quality veterinary supplements due to growing pet health concerns. Veterinary dietary supplements that support immune health have gained traction during 2020. Pet owners are also becoming more interested in novel products and ingredients such as CBD supplements and are seeking more specificity in product claims. This presents opportunities for veterinary dietary supplement manufacturers to launch products with functional ingredients that are proven to be safe and backed by adequate research.

Gather more insights about the market drivers, restrains and growth of the Global Veterinary Dietary Supplements Market

More and more pet parents are treating pets as members of the family. This trend in pet humanization has increased pet expenditure while leading to demand safe and nutritional products to support pet health. Many companies are expanding their portfolio with new products or expanding their regional reach to increase market share. In July 2020, Nutramax, launched Cosequin ASU pellets thus extending its joint health veterinary dietary supplements portfolio for horses. On the other hand, as per the 2020 statement by the chief executive of Blackmores, an Australian health supplements company, the company has plans to strengthen its position in pet vitamins and supplements markets. The company has also identified a new customer segment in the form of modern career women in China and has plans to enter the Indian market.

The need to ensure that pets achieve a healthier lifestyle is leading to premiumization of pet products including pet food and supplements. Market players can deliver on transparency and build trust by leveraging branded health ingredients and supplements that provide a clear point of reference to consumers when browsing shelves. As consumer preference shifts away from generic claims, market players have begun to list specific ingredients along with their proven health benefits.

The demand for condition-specific veterinary dietary supplements to support joint health, liver health, immune system, and digestive health is also expected to increase over time owing to growing awareness among pet owners and the availability of products. According to a 2018 study published in the Irish Veterinary Journal, horse owners/caregivers frequently use nutritional supplements to balance the diet, alleviate a health issue, provide additional nutrients for performance, modify behavior, and prevent health issues from occurring in horses. The study analyzed the results of a survey wherein 22% of the respondents commonly fed joint health supplements to their horses and 13% fed calming supplements.

In livestock, supplements are mostly used to address nutritional deficiencies. These may arise due to genetic conditions, medical conditions, or poor nutritional value of available feed. The growing need to secure animal health, product quality, and increase profitability is estimated to drive the demand for livestock supplements. For example, ruminating animals, such as dairy cows, often struggle with consuming adequate food to maintain an adequate supply of energy. Some farms may thus elect to use molasses for their herds as an energy supplement. Market players provide a variety of supplements to satisfy various nutritional needs of livestock animals. Virbac, for instance, provides a lineup of feed supplements to support udder health, fertility, growth rate, and overall health in cattle.

Browse through Grand View Research’s Animal Health Industry Research Reports.

- Veterinary Point Of Care Diagnostics Market: The global veterinary point of care diagnostics market size was valued at USD 1.27 billion in 2021 and is estimated to expand at a compound annual growth rate (CAGR) of 10.6% from 2022 to 2030.

- U.S. Pet Daycare Market: The U.S. pet daycare market size was valued at USD 1.12 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2022 to 2030.

Market Share Insights

- March 2021: Wind Point Partners acquired FoodScience Corporation that specializes in nutritional research and pet supplements.

- September 2020: Beaphar launched a lineup of natural calming products for companion animals such as spot-on, tablets, treats, collars, and home spray. The products help promote a calming effect in cats and dogs without causing drowsiness. The ingredients include natural plant extracts such as Limetree blossom, Rosemary, Hop flowers, and Melissa.

Key Companies profiled:

Some of the prominent players in the global veterinary dietary supplements market include:

- Boehringer Ingelheim

- Virbac

- Ark Naturals Company

- Beaphar

- FoodScience

- NOW Foods

- Nutramax Laboratories, Inc.

- Nutri-Pet Research, Inc.

- Ceva

- Canna Companion

- Nestle

Order a free sample PDF of the Veterinary Dietary Supplements Market Intelligence Study, published by Grand View Research.