Hospital Surgical Disinfectant Market Business Opportunities and Future Scope Till 2028

Hospital Surgical Disinfectant Industry Overview

The global hospital surgical disinfectant market size was valued at USD 330.83 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.0% from 2021 to 2028.

A high prevalence of chronic diseases, surge in hospital-acquired infections (HAIs), increasing number of surgical procedures, rising incidence of infectious disease, and the recent outbreak of COVID-19 are among the key factors driving the market growth. The high demand for proper sanitization in medical facilities during COVID-19 has tremendously boosted the use of surgical disinfectants in hospitals, clinics, and others. Thus, the spread of COVID-19 necessitates the implementation of preventive measures to limit the disease’s spread; as a result, hospitals are taking preventive measures. Thus, the COVID-19 pandemic has created potential opportunities for market players during the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Hospital Surgical Disinfectant Market

Moreover, HAIs are a major concern for patients as well as healthcare professionals globally. With a worldwide increase in the number of hospitalizations and HAIs, the demand for disinfection of surgical instruments is growing to minimize the risk of microbial contamination. As per the WHO estimates, hundreds of millions of patients develop HCAIs each year globally. Out of every 100 hospitalized patients, 7 in developed and 10 in developing countries are affected with at least one HAI. As a result, the rising incidence of these infections is likely to increase the demand for hospital surgical disinfectants in various healthcare facilities to limit the spread of infection. The application of disinfectant solutions in hospitals generally helps protect against contamination and lowers the risk of HAIs. This is expected to boost the market growth over the forecast period.

Furthermore, the rising number of surgical procedures in hospitals and growing awareness regarding infections and diseases are among the key factors expected to propel the market growth over the forecast period. For instance, as per the Mölnlycke Health Care AB 2019 annual report, around 70 million surgical procedures are performed each year in Europe. Similarly, according to the Healthcare Cost and Utilization Project (HCUP), in 2018, over 9,942,000 surgeries were performed in the U.S. within ambulatory care settings. In the case of surgeries, the use of surgical disinfectant products is one of the essential requirements in healthcare facilities. As these products inhibit or slow down the growth of microorganisms on the skin, these are more commonly used in hospitals and other medical settings to reduce the risk of infection during surgery and other procedures. Therefore, such instances are expected to drive the market over the forecast period.

Moreover, increasing demand for endoscopy is expected to increase the risk of getting HAIs. As per the British Society of Gastroenterology and BMJ Publishing Group Ltd. report in 2018, the demand for gastrointestinal endoscopy has grown immensely for bowel cancer screening in symptomatic patients. This is expected to drive the market for hospital surgical disinfectants over the forecast period.

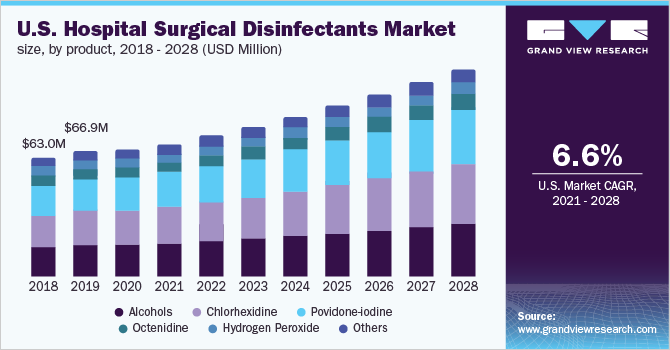

The U.S. dominated the market with a revenue share of over 80.0% in 2020 owing to the high prevalence of hospital-acquired infections and an increasing number of surgeries. For instance, as per the Healthcare Information and Management Systems Society, each day, 1 out of 25 patients in the U.S. is affected by hospital-acquired infections. An increase in the number of hospitals and the prevalence of infectious diseases such as tuberculosis, dengue, malaria, and typhoid including the current pandemic of COVID-19 are expected to drive the market in the U.S. Moreover, a well-defined regulatory framework established healthcare infrastructure, and a higher adoption rate of preventive products in surgeries are some other factors fueling the market growth in the country. This is expected to positively impact the market growth during the forecast period.

Furthermore, an increase in the incidence of chronic diseases, such as cardiovascular disorders, cancer, diabetes, and other autoimmune diseases, is anticipated to boost the hospitalization rate. Increased adoption of unhealthy and sedentary lifestyles and antimicrobial resistance are some of the major factors contributing to the growing prevalence of chronic diseases. According to the U.S. National Center for Health Statistics 2018, an estimated 157 million people in America are living with chronic disease, with 81 million having multiple conditions. Thus, the rising incidence of chronic conditions has significantly increased the hospital admission rate. The healthcare facilities constantly require surgical disinfectants to keep humans and non-living things germ-free. Such factors are expected to drive the demand for hospital surgical disinfectants during the forecast period.

Browse through Grand View Research’s Medical Devices Industry Research Reports.

- Medical Tourism Market – The global medical tourism market size was valued at USD 4.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 32.51% from 2022 to 2030.

- Antiseptics And Disinfectants Market – The global antiseptics and disinfectants market size was valued at USD 34.9 billion in 2021 and is expected to witness a compound annual growth rate (CAGR) of 10.1% from 2022 to 2030.

Market Share Insights

- March 2020: The Environmental Protection Agency (EPA) has released an updated list of EPA-registered disinfectants including surgical solutions that have been qualified for use against SARS-CoV-2.

- February 2019: Schülke & Mayr signed a distribution agreement with DKSH, one of the leading market expansion service providers. Under this agreement, DKSH will distribute and market a wide range of Schülke’s disinfectant products in China.

Key Companies profiled:

Some prominent players in the global hospital surgical disinfectant market include

- 3M

- Ecolab

- BD

- Sage Products LLC

- Braun Melsungen AG

- Johnson & Johnson

- Kimberly-Clark Corporation

- Cardinal Health

- The Clorox Company

- Schülke & Mayr GmbH

Order a free sample PDF of the Hospital Surgical Disinfectant Market Intelligence Study, published by Grand View Research.