Plastic Market Driver, Trends, Applications and Business Forecasts 2030

Plastic Industry Overview

The global plastic market size was valued at USD 593.00 billion in 2021. It is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2022 to 2030.

The increasing plastic consumption in the construction, automotive, and electrical & electronics industries is projected to support market growth during the forecast period. Regulations to decrease gross vehicle weight to improve fuel efficiency and eventually reduce carbon emissions are driving plastic consumption as a substitute for metals, including aluminum and steel, for manufacturing automotive components.

The growth of the construction industry in emerging markets such as Brazil, China, India, and Mexico has been instrumental in fueling the demand for plastics. The progress of the overall market can be attributed to increased foreign investment in these domestic construction markets, as a result of easing FDI norms and requirements for better public and industrial infrastructure.

Gather more insights about the market drivers, restrains and growth of the Global Plastic Market

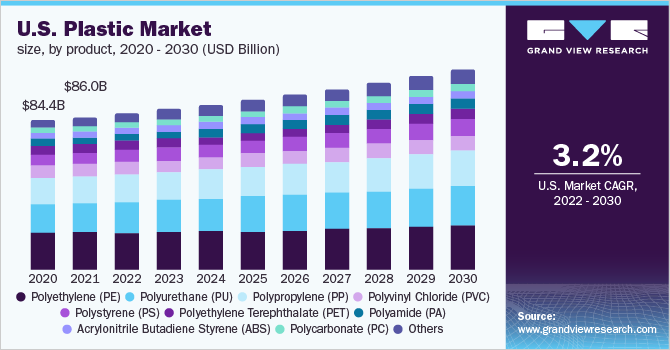

The plastics market demand in the U.S. was valued at USD 86.02 billion in 2021. The high market share of the country is attributed to the presence of the well-established automotive, aerospace & defense, and electronics industries. The country is characterized by a low-risk environment, a stable economy, and a robust financial sector. These factors have provided a multitude of opportunities for investors in recent years, which are likely to trigger infrastructure spending in the country. This, in turn, is projected to positively impact the demand for plastics in the U.S. construction industry.

The growing population, coupled with rapid urbanization and industrialization in emerging economies, has been impelling federal governments to increase their construction spending to cater to increasing infrastructure needs. Rising construction spending by governments, particularly in China and India, will drive the demand for plastic in infrastructure and construction applications.

Stringent regulations regarding depletion and recyclability of conventional materials such as metal and wood are anticipated to drive greater plastic demand from construction industries in insulation, pipes, cables, floorings, windows, storage tanks, and others. Polymer fittings are also generally quite simple and easy to install, compared to metals or wood, with a wide range of color combinations adding to their aesthetic appeal.

Plastic has 85% less specific gravity compared to metals. When used in the automotive and construction industries, they enable approximately 80% weight savings and 30% to 50% cost savings in individual components. The increasing incidences of positive cases of COVID-19 across the globe due to new virus variants are positively influencing the demand for plastic in medical devices such as testing equipment, ventilators, gloves, syringes, surgical trays, and medical bags.

Browse through Grand View Research’s Plastics, Polymers & Resins Industry Research Reports.

- Injection Molded Plastics Market – The global injection molded plastics market size was valued at USD 284.7 billion in 2021. It is expected to expand at a compound annual growth rate (CAGR) of 4.2% during the forecast period.

- Recycled Plastics Market – The global recycled plastics market size was valued at USD 46.09 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2022 to 2030.

Plastic Market Segmentation

Grand View Research has segmented the global plastic market on the basis of product, application, end-use, and region:

- Plastic Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 – 2030)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyurethane (PU)

- Polyvinyl chloride (PVC)

- Polyethylene terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile butadiene styrene (ABS)

- Polybutylene terephthalate (PBT)

- Polyphenylene Oxide (PPO)

- Epoxy Polymers

- Liquid Crystal Polymers

- Polyether ether ketone (PEEK)

- Polycarbonate (PC)

- Polyamide (PA)

- Polysulfone (PSU)

- Polyphenylsulfone (PPSU)

- Others

- Plastic Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 – 2030)

- Injection Molding

- Blow Molding

- Roto Molding

- Compression Molding

- Casting

- Thermoforming

- Extrusion

- Calendering

- Others

- Plastic End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2019 – 2030)

- Packaging

- Construction

- Electrical & Electronics

- Automotive

- Medical Devices

- Agriculture

- Furniture & Bedding

- Consumer Goods

- Utility

- Others

- Plastic Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 – 2030)

- North America

- Europe

- China

- Asia Pacific (excluding China)

- Central & South America

- Middle East & Africa

Market Share Insights

- August 2020: Sinopec Zhongke, China prepared to start a new unit for the production of polypropylene in Zhanjiang by the end of August 2020. The unit possesses a production capacity of 350,000 tons/year of polypropylene.

Key Companies profiled:

Some prominent players in plastic market include,

- BASF SE

- SABIC

- Dow Inc

- DuPont de Nemours, Inc

- Evonik Industries

- Sumitomo Chemical Co., Ltd.

- Arkema

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Co., LLC

- Lotte Chemical Corporation

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Covestro AG

- Toray Industries, Inc.

- Mitsui & Co. Plastics Ltd.

Order a free sample PDF of the Plastic Market Intelligence Study, published by Grand View Research.